Understanding Accredited Investors: A Guide by the SEC

By RJ Johnson January 13, 2025

In the world of investing, the term “accredited investor” often surfaces, especially when discussing private investment opportunities. But what exactly does it mean to be an accredited investor, and why does it matter? Let’s delve into the definition provided by the U.S. Securities and Exchange Commission (SEC) and explore its significance in the investment landscape.

What is an Accredited Investor According to the SEC?

An accredited investor is an individual or entity that meets specific financial criteria set by the SEC, allowing them to invest in private securities offerings. These criteria are designed to ensure that investors have the financial sophistication and capacity to absorb potential losses from riskier investments that are not registered with the SEC.

Criteria for Individuals

For individuals, the SEC outlines several criteria to qualify as an accredited investor:

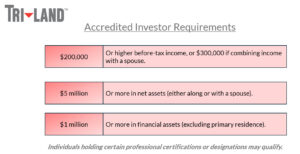

Income Test: An individual must have an annual income exceeding $200,000 (or $300,000 combined with a spouse) for the last two years, with the expectation of earning the same or higher income in the current year.

Net Worth Test: An individual must have a net worth exceeding $1 million, either alone or together with a spouse, excluding the value of their primary residence.

Professional Certifications: Individuals holding certain professional certifications, designations, or credentials, such as a Series 7, Series 65, or Series 82 license, may also qualify as accredited investors.

Criteria for Entities

Entities can also qualify as accredited investors if they meet certain conditions:

Assets Test: An entity, such as a corporation, partnership, or trust, must have total assets exceeding $5 million.

Ownership Test: An entity in which all the equity owners are accredited investors.

Certain Institutions: Banks, insurance companies, registered investment companies, business development companies, and small business investment companies automatically qualify as accredited investors.

Why Does Accreditation Matter?

Accredited investors have access to a broader range of investment opportunities, including private equity, venture capital, hedge funds, and other private placements. These investments often offer the potential for higher returns but come with increased risk and less regulatory oversight compared to publicly traded securities.

The SEC’s accreditation criteria aim to protect less experienced investors from the complexities and risks associated with these private investments. By ensuring that only financially sophisticated individuals and entities participate, the SEC seeks to mitigate the potential for significant financial loss.

Recent Updates and Considerations

In recent years, the SEC has expanded the definition of accredited investors to include individuals with certain professional knowledge, experience, or certifications. This change acknowledges that financial sophistication isn’t solely determined by income or net worth.

It’s important for potential investors to understand that meeting the criteria for accreditation doesn’t guarantee investment success. Accredited investors should still conduct thorough due diligence and consider seeking advice from financial professionals before committing to any investment.

Conclusion

Being an accredited investor opens doors to exclusive investment opportunities that are not available to the general public. However, with these opportunities come increased responsibilities and risks. Understanding the SEC’s criteria for accreditation is crucial for anyone considering entering this realm of investing.

As the investment landscape continues to evolve, staying informed about the qualifications and implications of being an accredited investor will help individuals and entities make sound financial decisions. Whether you’re a seasoned investor or just beginning to explore private investments, knowing your status as an accredited investor is a vital step in navigating the complex world of finance.

If you are interested in learning more, please contact RJ Johnson.