What is cash on cash return?

By RJ Johnson June 27, 2023

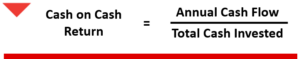

The cash on cash return formula evaluates the cash income generated by an investment property relative to the amount of cash invested by the investor. You can express it as a percentage and it will measure the annual cash return on the total amount of cash invested in a property. The abbreviation for cash on cash return is “CoC” or “CCR”.

In the case of commercial grocery-anchored real estate, Tri-Land believes that CCR is an important metric. It allows investors to assess the amount of cash flow generated by the property and evaluate its profitability. It is a useful tool to compare different investment opportunities and determine the best use of capital.

The cash on cash formula is calculated by dividing the property’s annual pre-tax cash flow by the total amount of cash invested in the property. The cash flow includes rental income, minus operating expenses, debt service, and any other expenses. Cash invested may include the down payment, closing costs, and any capital expenditures made by the investor.

As an example, suppose an investor purchases a grocery-anchored property for $10 million, makes a down payment of $2 million, and incurs additional closing costs of $100,000. The investor also spends $500,000 on capital expenditures to improve the property. In the first year, the property generates an annual cash flow of $800,000.

Cash on Cash Return Formula

You calculate the cash on cash return formula as follows:

CCR = Annual Cash Flow / Total Cash Invested

= $800,000 / ($2,100,000 + $500,000)

= 29.4%

This means that the investor’s cash investment of $2.6 million generated an annual cash return of $800,000, which represents a 29.4% return on investment.

CCR is used in financial evaluations of commercial grocery-anchored real estate. It compares returns on investment opportunities and helps determine the best use of capital. Investors prefer properties with higher cash on cash return, as they offer more cash income relative to the invested amount. However, it’s important to consider other factors like location, tenant mix, and market conditions when making investment decisions.

Tri-Land Properties is a commercial real estate developer that focuses on the redevelopment of grocery anchored real estate projects. As part of our normal business practice, we been evaluating real estate CCR since 1978 for passive real estate investors. Accredited investors can have access to institutional grade grocery anchored real estate investments.

For further details, please contact RJ Johnson at Tri-Land Properties.