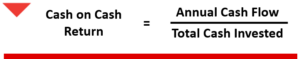

The cash on cash return formula evaluates the cash income generated by an investment property relative to the amount of cash invested by the investor. You can express it as a percentage and it will measure the annual cash return on the total amount of cash invested in a property. The abbreviation for cash on cash return is “CoC” or “CCR”.

In the case of commercial grocery-anchored real estate, Tri-Land believes that CCR is an important metric. It allows investors to assess the amount of cash flow generated by the property and evaluate its profitability. It is a useful tool to compare different investment opportunities and determine the best use of capital.

The cash on cash formula is calculated by dividing the property’s annual pre-tax cash flow by the total amount of cash invested in the property. The cash flow includes rental income, minus operating expenses, debt service, and any other expenses. Cash invested may include the down payment, closing costs, and any capital expenditures made by the investor.

As an example, suppose an investor purchases a grocery-anchored property for $10 million, makes a down payment of $2 million, and incurs additional closing costs of $100,000. The investor also spends $500,000 on capital expenditures to improve the property. In the first year, the property generates an annual cash flow of $800,000.

Cash on Cash Return Formula

You calculate the cash on cash return formula as follows:

CCR = Annual Cash Flow / Total Cash Invested

= $800,000 / ($2,100,000 + $500,000)

= 29.4%

This means that the investor’s cash investment of $2.6 million generated an annual cash return of $800,000, which represents a 29.4% return on investment.

CCR is used in financial evaluations of commercial grocery-anchored real estate. It compares returns on investment opportunities and helps determine the best use of capital. Investors prefer properties with higher cash on cash return, as they offer more cash income relative to the invested amount. However, it’s important to consider other factors like location, tenant mix, and market conditions when making investment decisions.

Tri-Land Properties is a commercial real estate developer that focuses on the redevelopment of grocery anchored real estate projects. As part of our normal business practice, we been evaluating real estate CCR since 1978 for passive real estate investors. Accredited investors can have access to institutional grade grocery anchored real estate investments.

For further details, please contact RJ Johnson at Tri-Land Properties.

Net operating income (NOI) is a financial metric utilized in real estate to assess the income generated from a property after considering all operating expenses, excluding debt service and income taxes. It is calculated by deducting operating expenses from the property’s gross operating income (GOI). Operating expenses encompass property management fees, property taxes, insurance, utilities, repairs and maintenance, as well as other necessary expenses for property upkeep.

In the realm of commercial grocery-anchored real estate, NOI holds significance as it determines the property’s value and potential return on investment. A higher NOI generally corresponds to a greater property value and increased potential return for investors.

When evaluating the financial performance of a grocery-anchored property, investors may derive the property’s cap rate by dividing the NOI by the property’s market value. A higher cap rate implies a greater potential return on investment, whereas a lower cap rate indicates a diminished potential return.

Additionally, investors can employ the NOI to calculate other financial metrics, including cash-on-cash return, internal rate of return (IRR), and equity multiple. These metrics aid in further assessing the property’s financial performance and potential profitability.

What is operating income vs net operating income?

In commercial real estate, both net operating income (NOI) and operating income play crucial roles as financial metrics for evaluating the financial performance of a commercial real estate investment property. However, their calculations and implications differ.

Operating income in commercial real estate pertains to the income derived from the property’s operations prior to subtracting operating expenses. It is determined by deducting operating expenses (such as property taxes, insurance, maintenance costs, property management fees, and utilities) from the property’s gross income. Operating income helps investors comprehend the income generated solely from the property’s operations, excluding any non-operational income or expenses.

On the other hand, net operating income or NOI is a more comprehensive measure that reflects the property’s profitability after accounting for all operating expenses. It is computed by subtracting all operating expenses, including property taxes, insurance, maintenance costs, property management fees, utilities, and other relevant expenses, from the property’s gross income. NOI provides a clearer understanding of the property’s ability to generate income through its operations and is frequently employed in investment analysis and valuation.

NOI Formula

Let’s consider a commercial property that generates an annual gross income of $300,000. The property has operating expenses, including property taxes, insurance, maintenance , and utilities, totaling $100,000 per year. The property has additional expenses totaling $25,000 for property management fees making the total operating expenses $125,000.

Operating income = Gross income – Operating expenses

Operating income = $300,000 – $100,000

Operating income = $200,000

Net operating income (NOI) = Gross income – Total operating expenses

NOI = $300,000 – $125,000

NOI = $175,000

Real estate investors often recognize the complexity of commercial real estate operating income and net operating income (NOI), which is why partnering with experienced real estate operators is crucial. Tri-Land Properties, a seasoned commercial real estate operator, specializes in grocery-anchored real estate developments and has been actively involved in this field since 1978. With over 40 years of experience, we have diligently assessed real estate risks and returns for investors.

By investing with Tri-Land Properties, accredited investors gain the opportunity to access institutional-grade grocery-anchored real estate investments. Our expertise and track record in the industry enable us to provide valuable insights and potential investment opportunities in this sector. To learn more about our offerings and discuss further, please reach out to RJ Johnson at Tri-Land Properties.

What are the four main investment strategies in commercial real estate?

There are four main investment strategies when evaluating commercial real estate which include Core, Core+, Value-Add and Opportunistic. When discussing real estate investments I may occasionally reference these strategies as the “Core Four”. These terms are used in to describe different real estate investment strategies based upon the risk and return profile of the investment.

Four Main Investment Strategies

- Core: Core investments are the least risky of the Core Four. These investments typically involve properties that are already built, fully leased, and generating steady income. The main objective of core investments is to provide stable and predictable income streams with minimal risk. Core properties are often located in prime locations with high demand and stable occupancy rates.

- Core+: Core Plus investments are slightly riskier than core investments. These properties may have minor management or physical issues that can be improved to increase cash flow and value. Core Plus investments can provide slightly higher returns than core investments due to their potential for value enhancement.

- Value-Add: Value-Add investments involve buying a property that is in need of renovation, repositioning, or restructuring to increase its value. These investments carry more risk than Core or Core Plus investments but offer higher returns. Value-Add investments may require additional capital to make improvements, and investors must have a clear plan to increase the property’s value to be successful.

- Opportunistic: Opportunistic investments are the riskiest of the Core Four strategies. These investments involve properties that require major repositioning or development to create value. The properties may be in poor condition or may require significant capital investments to generate income. However, successful Opportunistic investments offer the highest potential returns.

Core Investment Strategies

A Core Investment in commercial real estate is a low-risk, low-return investment strategy. The investor seeks to acquire a stable, income-generating property that requires minimal or no improvements. These properties may be fully leased to credit-worthy tenants and located in prime locations, providing consistent cash flow and long-term appreciation.

The Core Investments Pros:

- Stable and Predictable Income: Core investments provide stable and predictable income through long-term leases to credit-worthy tenants.

- Lower Risk: They are lower-risk investments due to the stable cash flow and low dependence on market conditions.

- Low Capital Expenditures: Core investments require minimal or no capital expenditures, which reduce the initial investment and increase the investor’s overall returns.

- Liquidity: Typically, core investments are more liquid than other commercial real estate investments, allowing investors to easily enter and exit the investment.

The Core Investments Cons:

- Limited Upside Potential: Core Investments have limited potential for significant value enhancement compared to value-add or opportunistic investments.

- Lower Returns: They may offer lower returns than other commercial real estate investments due to the low risk profile.

- Market Risk: Core Investments are still subject to market risk, as the success of the investment is still dependent on market conditions.

- Limited Diversification: They may not provide much diversification to an investor’s portfolio, as these investments are typically located in prime locations and focused on one property type.

Core investments can provide a stable and predictable income stream for private real estate investors seeking low-risk investments with consistent long-term appreciation. However, investors should carefully consider their investment goals and risk tolerance before investing. Investors should be aware of the limited upside potential and lower returns compared to other commercial real estate investments.

Core+ Investment Strategies

Core Plus, commonly known as “Core+”, investment strategy is a moderate-risk, moderate-return investment strategy. The investor seeks to acquire a property that requires some improvements, but with less risk than a value-add or opportunistic investment. The properties may be fully leased and generating stable cash flow, but could benefit from additional capital expenditures to enhance the property’s income-generating potential.

The Core Plus Pros:

- Moderately High Returns: Core Plus investments offer the potential for higher returns than core investments due to the value-add component, but with less risk than value-add or opportunistic investments.

- Reduced Risk: Core+ investments are less risky than value-add or opportunistic investments since they involve less capital expenditures and have less dependence on market conditions.

- Stability: The property may be fully leased and generating stable cash flow, providing the investor with consistent and predictable income

- Diversification: These investments can provide diversification to an investor’s portfolio by investing in different types of properties or in different geographical locations.

The Core+ Cons:

- Limited Upside Potential: Core+ investments have less potential for significant value enhancement compared to value-add or opportunistic investments.

- Longer Holding Period: They may require a longer holding period than core investments as additional capital expenditures and redevelopment may take time.

- Capital Expenditures: Core Plus investments require additional capital expenditures, which can increase the initial investment and potentially reduce the investor’s overall returns.

- Market Risk: These investments are still subject to market risk, as the success of the investment is still dependent on market conditions.

These Core+ investments can offer a balanced risk and return profile. Some investors seeking moderately high returns with less risk than value-add or opportunistic will choose this investment strategy. However, investors should still conduct thorough due diligence and consider the investment’s potential downside risks before investing.

Value Add Investment Strategies

Value-Add investment is a strategy in commercial real estate where an investor purchases a property that has the potential to increase its value through renovation, repositioning, or other improvements. The goal is to improve the property’s income-generating capabilities and increase its overall value, resulting in higher returns for the investor.

The Value-Add Pros:

- Potential for High Returns: Value-Add investments offer the potential for higher returns than core or core plus investments because the investor is able to increase the property’s value and cash flow.

- Control: As the owner of the property, the investor has control over the property’s management, leasing, and capital expenditures, allowing for greater control over the investment’s performance

- Diversification: Value add investments can provide diversification to an investor’s portfolio by investing in different types of properties or in different geographical locations.

The Value-Add Cons:

- Higher Risk: Value-Add investments are riskier than core or core plus investments because they involve additional capital expenditures and renovation, repositioning, or restructuring to increase the property’s value.

- Longer Holding Period: Value-Add investments often require a longer holding period before the investor can realize the increased value and higher returns.

- Capital Expenditures: These investments require additional capital expenditures, which can increase the initial investment and potentially reduce the investor’s overall returns.

- Market Risk: The success of a value add investment is heavily dependent on the overall market conditions, such as supply and demand, interest rates, and economic growth, which can impact the property’s value and cash flow.

Value-Add investments can be a lucrative investment strategy for private real estate investors. Investors need to understand that these increased returns also carries more risk and requires careful evaluation and planning. Investors should consider their risk tolerance, investment goals, and experience before investing in a value-add investment strategy.

Opportunistic

An opportunistic Investment in commercial real estate is a high-risk, high-reward investment strategy. The investor seeks to acquire a property that requires significant improvements or redevelopment to generate higher returns. The properties may have been underutilized, poorly managed, or in distressed financial conditions.

The opportunistic Pros:

- High Potential Returns: The primary benefit of Opportunistic Investments is the potential for high returns. These investments can offer the highest returns in commercial real estate due to the significant value enhancement that can be achieved by making improvements to the property.

- Control: As the owner of the property, the investor has control over the property’s management, leasing, and capital expenditures, allowing for greater control over the investment’s performance

- Diversification: Opportunistic investments can provide diversification to an investor’s portfolio by investing in different types of properties or in different geographical locations.

The opportunistic Cons:

- High Risk: Opportunistic Investments are the riskiest of all real estate investment strategies, as they involve significant capital expenditures, redevelopment, and repositioning of the property. The success of the investment depends heavily on market conditions, which are beyond the investor’s control.

- Longer Holding Period: These properties often require a long holding period before the investor can realize returns. The property may take time to reposition, and it may take longer to find the right buyer or tenant to realize the investment’s full potential.

- Capital Expenditures: Opportunistic investments require significant capital expenditures, which can increase the initial investment and potentially reduce the investor’s overall returns.

- Limited Exit Strategies: These investments may have limited exit strategies. They may not be as liquid as other commercial real estate investments, and the investor may face challenges when trying to sell the property.

Opportunistic Investments offer high potential returns but also carry high risk. Investors should consider their risk tolerance, investment goals, and experience before embarking on an Opportunistic Investment strategy. Additionally, it is essential to conduct thorough due diligence and have a clear exit strategy before investing.

Tri-Land Properties is a commercial real estate developer that focuses on grocery-anchored real estate investment strategies. We have been producing risk-adjusted returns for passive investors since 1978. By investing with Tri-Land, an accredited investor can have access to institutional grade grocery anchored real estate investments. To learn more, please contact RJ Johnson at Tri-Land Properties.

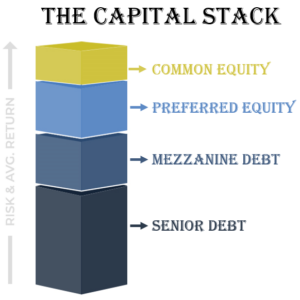

What is the capital stack in real estate? The capital stack in real estate refers to the organization, or tiers, of debt or equity contributed to finance a real estate transaction, or a company, organized by their risk-return profile. These tiers are typically organized from lowest risk, senior debt, to highest risk, common equity. It represents the combination of different capital layers that make up the overall capital structure of a real estate investment. The capital stack typically includes both debt and equity components and the arrangement and priority of these components determine the risk and return profile for both investors and passive investors.

Here are the common components found in a typical capital stack, listed in order of priority:

- Senior Debt: Senior debt is the primary layer of financing in the capital stack. It typically takes the form of a traditional bank loan or a commercial mortgage. Senior debt holders have the first claim on the property’s cash flows and collateral in case of default or foreclosure. They have priority over all other capital providers in terms of repayment. Senior debt is considered a lower-risk investment, and lenders often require collateral and impose covenants to protect their interests. The interest rates on senior debt are typically lower compared to other types of financing.

- Mezzanine Debt: Mezzanine financing fills the gap between senior debt and equity in the capital stack. Mezzanine loans are often provided by private equity firms or specialized lenders. Mezzanine debt holders have a subordinate position to senior debt but rank above equity holders. In the event of default or foreclosure, mezzanine lenders can step in and take control of the property. Mezzanine loans usually carry higher interest rates than senior debt due to the increased risk. They are attractive to investors seeking higher yields, and they provide additional leverage beyond what senior debt offers.

- Preferred Equity: Preferred equity occupies a higher position in the capital stack compared to common equity. Preferred equity holders receive a fixed return or priority distribution before any distributions are made to common equity holders. Preferred equity may offer a higher rate of return compared to senior debt but carries more risk. In the event of liquidation, preferred equity holders have priority over common equity holders in receiving their initial investment back. Preferred equity is often utilized in situations where investors seek a higher yield than senior debt but are not looking for full ownership or control.

- Common Equity: Common equity represents the ownership stake in the property or project. Common equity holders participate in the property’s cash flows and profits but are the last to receive distributions after all other capital providers have been paid. Common equity investors bear the highest risk but also have the potential for the highest returns. They have voting rights and influence over major decisions regarding the property. Common equity can be held by individual investors, partnerships, real estate investment trusts (REITs), or private equity funds.

The specific composition and order of the capital stack can vary depending on the project, investors involved, and the risk-return objectives of the stakeholders. Each layer of the capital stack carries different rights, priorities, and levels of risk and return, reflecting the different interests of the various capital providers.

Tri-Land Properties is a commercial real estate developer that focuses on grocery anchored real estate developments. We have been producing risk-adjusted returns for passive investors since 1978. By investing with Tri-Land, an accredited investor can have access to institutional grade grocery anchored real estate investments run by a 40+ year successful real estate company. To learn more, please contact RJ Johnson at Tri-Land Properties.

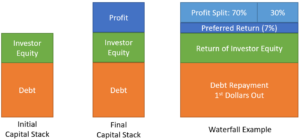

What is an Equity Waterfall Structure in Real Estate?

What is a waterfall structure in real estate? In real estate, an equity waterfall structure refers to a method of distributing profits among the participants in a real estate syndication or partnership. It outlines the order and priority in which profits are distributed to the various parties involved. The waterfall structure is typically defined in the partnership agreement or operating agreement and serves as a framework for profit sharing.

Here’s a general overview of how a typical waterfall structure works:

- Return of Capital: The first priority is often the return of the initial capital investment to the investors. This means that any funds invested in the project are distributed back to the investors until they have received their original investment amount.

- Preferred Return: Once the investors have received their initial capital, the next step is to allocate a preferred return to the investors. The preferred return is a predetermined rate of return, typically expressed as a percentage, that the investors are entitled to receive before the general partner (syndicator) receives any profits. This ensures that the investors receive a certain level of return on their investment before the syndicator starts earning profit.

- Profit Split: After the preferred return has been distributed to the investors, any remaining profits are divided between the investors and the general partner according to a predetermined split ratio. This split ratio specifies the percentage of profits allocated to each party. Common split ratios range from 80/20 (where 80% goes to the investors and 20% to the general partner) to 50/50 (an equal split). However, the split ratio can vary depending on the negotiation and terms agreed upon by the parties involved.

- Promote or Performance-Based Profits: In some cases, there may be an additional layer of profit sharing beyond the preferred return and split ratio. This is often referred to as the “promote” or “carried interest.” The general partner, having met certain performance benchmarks or achieved a specific level of profitability, becomes eligible for an increased share of profits above the predetermined split ratio. The promote structure provides an incentive for the syndicator to generate exceptional returns for the investors.

It’s important to note that waterfall structures can be customized and tailored to the specific needs and objectives of the real estate syndication. The specific terms of the waterfall structure, including the preferred return, split ratios, and promote provisions, are negotiated and outlined in the partnership agreement. It’s essential for all parties involved to carefully review and understand the waterfall structure to ensure clarity and alignment of interests.

It’s recommended to consult with legal and financial professionals experienced in real estate syndications to establish an appropriate waterfall structure that reflects the goals, risk profiles, and expectations of the participants.

Waterfall Example

Here’s an example of an equity waterfall structure using a 7% preferred return and a 70/30 split:

- Return of Capital: The initial capital investment is returned to the investors before any profits are distributed.

- Preferred Return: Once the investors have received their initial capital, they are entitled to a preferred return of 7% per annum on their invested capital. This means that the investors will receive a 7% return on their investment before the general partner receives any profits.

- Profit Split: After the preferred return has been distributed to the investors, any remaining profits are divided between the investors and the general partner based on a 70/30 split ratio.

- 70% to Investors: 70% of the remaining profits are allocated to the investors.

- 30% to General Partner: The remaining 30% of the profits are allocated to the general partner.

Assuming the initial capital invested by the investors is $1,000,000, and the project generates a total profit of $200,000.

Return of Capital: The initial capital of $1,000,000 is returned to the investors.

Preferred Return: Assuming the project took one year to generate the profits, the preferred return of 7% per annum on the invested capital would be $70,000 ($1,000,000 x 7%). This amount is distributed to the investors.

- Profit Split: After deducting the preferred return, the remaining profit is $130,000 ($200,000 – $70,000).

- 70% to Investors: The investors would receive 70% of the remaining profit, which is $91,000 ($130,000 x 70%).

- 30% to General Partner: The general partner would receive 30% of the remaining profit, which is $39,000 ($130,000 x 30%).

In this example, the investors receive their preferred return of $70,000 and an additional $91,000 as their share of the profit split, resulting in a total distribution of $161,000. The general partner receives $39,000 as their share of the profit split.

IRR Example

To calculate the Internal Rate of Return (IRR) for the given example, we need to consider the cash flows associated with the investment and solve for the discount rate that equates the present value of those cash flows to zero. Here’s how you can calculate the IRR:

Initial Investment: -$1,000,000 (negative value represents cash outflow)

Cash Inflows:

Year 1: Preferred Return – $70,000

Year 1: Profit Distribution to Investors – $91,000

To calculate the IRR, we’ll input the cash flows into a financial calculator that has the IRR function. The IRR represents the annualized rate of return that makes the net present value (NPV) of all the cash flows equal to zero.

IRR = Calculate IRR(-$1,000,000, $70,000, $91,000)

IRR= 12.36%

The IRR indicates the average annual return that the investment is expected to generate over its holding period, taking into account the timing and magnitude of cash flows. In this case, the IRR suggests that the investment is expected to yield an average annual return of approximately 12.36% based on the cash flows provided.

It’s important to note that this is a simplified example, and in practice, the calculations and distribution may involve more complex factors, including the duration of the investment, additional fees, expenses, and potential hurdles or benchmarks that need to be met before profit distributions are made. The specific terms of the waterfall structure would be outlined in the partnership agreement, and it’s advisable to consult with legal and financial professionals to ensure accurate implementation and understanding.

Catch-Up Equity Waterfall Clause

In real estate syndication, a catch-up clause refers to a provision within the waterfall structure that allows the sponsor or general partner (GP) to receive a higher share of profits until they “catch up” or receive a predetermined percentage of the profits. It is typically used in situations where the GP receives a disproportionate share of profits in the early stages of the investment to compensate for their upfront costs and efforts, but then the profit distribution shifts to favor the limited partners (LPs) as the project progresses.

The catch-up clause ensures that once the LPs have received their preferred return or a certain level of profit, the GP’s share of profits is adjusted to align with the agreed-upon profit distribution. The GP will receive a greater share of profits until they reach their catch-up threshold, after which the profit distribution is typically adjusted to favor the LPs.

Here’s a simplified example to illustrate how a catch-up clause works in a real estate syndication equity waterfall structure:

Let’s say the equity waterfall structure is structured as follows:

Preferred Return: LPs receive an 8% annual return on their invested capital.

Catch-Up: Once LPs receive their 8% preferred return, the GP receives 30% of the remaining profits until they catch up to a cumulative total of 20% of the total profits.

After the Catch-Up: Once the GP has received its 20% catch-up share, the remaining profits are distributed between the GP and LPs, typically with a ratio of 70% to LPs and 30% to GP.

Suppose the project generates $1 million in profits. In the first year, the LPs would receive their 8% preferred return, which amounts to $80,000. The remaining profits are $920,000.

With the catch-up clause, the GP will receive 30% of the remaining profits until they catch up to 20% of the total profits. In this case, the GP would receive $276,000 (30% of $920,000) in addition to the preferred return, bringing their total share to $356,000.

After the catch-up threshold is reached, the remaining profits of $644,000 would be distributed between the LPs and GP according to the predetermined ratio (70% to LPs and 30% to GP). In this example, the LPs would receive $450,800 (70% of $644,000), and the GP would receive $193,200 (30% of $644,000).

Please note that the actual catch-up clause terms and percentages can vary depending on the specific agreement between the GP and LPs in a real estate syndication. It’s important to review the partnership agreement or offering documents for precise details on how the catch-up clause operates in a particular investment.

Tri-Land Properties is a commercial real estate developer that focuses on the redevelopment of grocery anchored real estate projects. We have been evaluating real estate projects and evaluating equity waterfall structure since 1978 for passive real estate investors. Accredited investors can have access to institutional grade grocery anchored real estate investments. To learn more, please contact RJ Johnson at Tri-Land Properties.